The FCA’s analysis of the financial resilience of firms has signalled a coronavirus-driven market downturn may cause “significant numbers” of firms to fail over the next 12 months.

The FCA’s analysis of the financial resilience of firms has signalled a coronavirus-driven market downturn may cause “significant numbers” of firms to fail over the next 12 months.

Advisers were among the 5,159 coronavirus financial resilience survey respondents in the “retail investments” sector, which also included platforms, Sipp operators, wealth managers and crowdfunders.

The regulator has excluded responses from the “pensions and retirement income” sector in the aggregated data it has published for its surveys to avoid firms being identified.

In response to the coronavirus crisis, the regulator has been monitoring the effects of the economic downturn on firms’ solvency.

It says it has been “rapidly increasing” the data it collects on regulated firms and last year sent a survey to 23,000 firms to get a picture of their financial resilience during the pandemic.

FCA launches major Covid-19 surveyThe regulator has suggested there could be “significant harm to consumers” as the current economic downturn is likely to “disproportionately impact” some sectors and types of business models.

It has warned this could reduce effective competition and or/damage the “overall effectiveness and reputation” of the market in which the firms operate.

But it adds the situation is “rapidly evolving” in these “unprecedented times” in terms of economic impact and levels of government support.

This morning, the FCA published the results of its Covid-19 surveys, which were sent in two tranches in 2020.

The surveys were sent to solo-regulated firms.

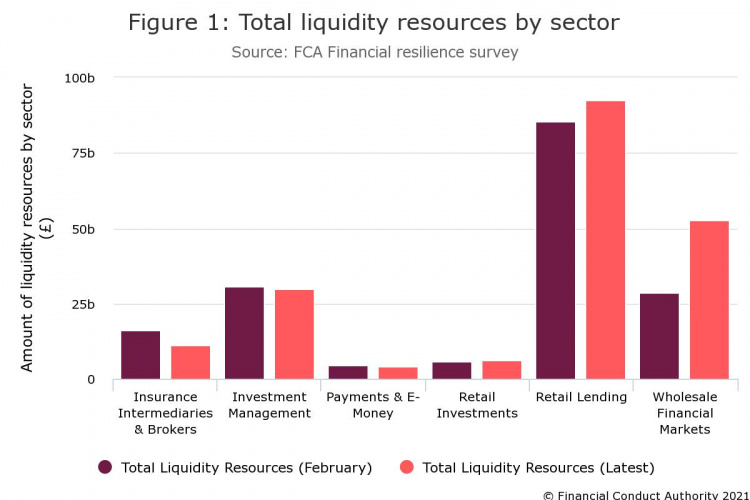

Results show that between February (pre-lockdown) and May/June (during the impact of the first lockdown), firms across the sectors experienced significant change in their total amount of liquidity. This was defined as cash, committed facilities and other high-quality liquid assets.

Three sectors saw a decrease in available liquidity: Insurance Intermediaries and Brokers (30 per cent), Payments and E-Money (11 per cent) and Investment Management (2 per cent).

The other three sectors saw an increase in liquidity between the two reporting periods: Retail Investments (8 per cent), Retail Lending (8 per cent) and Wholesale Financial Markets, which saw the greatest increase with 83 per cent.

The survey discovered that more than half (59 per cent) of firms expected coronavirus to have a negative impact on their net income.

Of these, 72 per cent expected the impact to be between 1 per cent and 25 per cent while 3 per cent expected the impact to be more than 76 per cent within the next three months of the survey being taken.

FCA reassures IFAs Covid survey is ‘not a scam’

FCA executive director of consumers and competition Sheldon Mills says: “We are in an unprecedented and rapidly evolving situation. This survey is one of the ways we are continuing to monitor the potential impact of coronavirus on firms.

“A market downturn driven by the pandemic risks significant numbers of firms failing. At end of October we’ve identified there are 4,000 financial services firms with low financial resilience and at heightened risk of failure, though many will be able to bolster their resilience as and when economic conditions improve. These are predominantly small and medium sized firms and approximately 30 per cent have the potential to cause harm in failure.

“Our role isn’t to prevent firms failing. But where they do, we work to ensure this happens in an orderly way. By getting early visibility of potential financial distress in firms we can intervene faster so that risks are managed and consumers are adequately protected.”

The regulator adds: “Examining our survey responses in the context of the Bank of England’s macroeconomic scenarios over the next year, we expect that failures due to the current economic downturn are likely to disproportionately impact some sectors and types of business models, creating potentially significant harm to consumers. This could reduce effective competition, and/or damage the overall effectiveness and reputation of the market in which the firms operate.”

The survey was conducted before recent developments “which will have an impact on the market such as the extension of the government’s furlough scheme, the positive vaccine developments and the announcement of new rules and restrictions.”

Survey responses

The regulator has aggregated the survey results for each question by sector to ensure that no individual firm can be identified. It categorises firms into seven sectors: General Insurance and Protection, Investment Management, Pensions and Retirement Income, Retail Banking, Retail Investments, Retail Lending and Wholesale Financial Markets.

As at 11 October 2020, it had received 17,115 responses to the June and August surveys. With the recent repeat of the survey across the same 23,000 firms it now has a response from approximately 19,000 firms.

Below is the number of respondents per sector for phase one along with a description of the types of firms included within each sector:

- Insurance Intermediaries and Brokers (3,370 respondents): covers insurance intermediaries, Lloyds and London Market intermediaries and price comparison websites with general insurers not included as they are dual regulated. The label has therefore been changed from ‘General Insurance and Protection’ to more accurately reflect the nature of the firms surveyed.

- Investment Management (2,036 respondents): sector covers asset management, benchmarks, alternatives, custody services and contracts for difference providers.

- Payments and E-Money (715 respondents): covers the payments and e-money firms within the retail banking sector with banks, building societies and credit unions not included as they are dual regulated. The label has therefore been changed from ‘Retail Banking’ to more accurately reflect the nature of the firms surveyed.

- Retail Investments (5,159 respondents): sector covers crowdfunders, advisers and intermediaries, self-invested personal pension operators, platforms and wealth managers.

- Retail Lending (4,976 respondents): sector covers non-bank lenders, mortgage third party administrators, mortgage intermediaries, credit reference agencies, debt purchasers, collectors and administrators, debt advice firms, motor finance providers, peer to peer lending platforms, high cost lenders and mainstream consumer credit lenders. Credit brokers were excluded from the survey due to their low harm in failure.

- Wholesale Financial Markets (853 respondents): covers exchanges, multilateral trading facilities, wholesale brokers, principal trading firms and other wholesale investment firms.

- Pensions & Retirement Income: covers life third party administrators. As dual regulated insurers are excluded, the remaining number of solo-regulated firms in this sector responding to the survey is small and risks identification. We have therefore excluded the responses from this sector from the publication.

Source: FCA

Seriously who cares …..?

I mean come on …who really does care ?

Government # treasury…. lots of fines still to come their way

FCA….they have already stated they will not help firms

The consumer ……confidence is already at an all time low due to scams and the feckless

Trade bodies…well they are not much use are they ?

Fellow IFA firms …..will hope to pick up more clients to balance the increased cost resulting in a nil position

The great British press…. IFA firms going bust you say (tumble weed blows across the office floor) hey !!! hot topic has anyone asked how Megan is today ? and photographers get out and get pictures of so called celebrities that no-one has ever heard of.

The only person this effects is the one, who out the corner of their eye has just seen the grave digger smiling at the refection in his spade ….

well said DH now were is my camera

“Significant number of firms could fail this year”

No kidding – who would have guessed?

Why do you think there is so much activity with consolidators and acquirers? The sharks are in the water hoping to acquire funds under management on the cheap

well said Harry

who really cares. Certainly not the FCA who will just spread there costs across the few that are left

The FCA fails (in its duties) all the time but will never fail financially. What a great position to be in.