U.K. Banks Near Agreement on Plan to Recover Soured Covid Loans

U.K. Banks Near Agreement on Plan to Recover Soured Covid Loans

(Bloomberg) -- British banks are finalizing plans for outsourcing the recovery of billions of pounds in taxpayer-backed business loans issued during the Covid-19 pandemic.

A consortium of lenders is expected to set up an entity that will oversee debt collectors tasked with chasing bad loans, people with knowledge of the matter said. A final decision is expected in early December, said the people, who asked not to be named discussing private information.

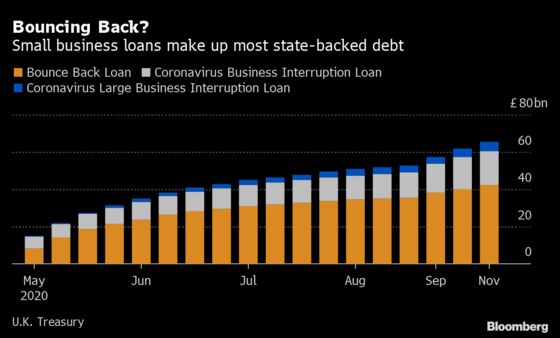

The largest government-backed loan initiative, known as the Bounce Back program, stands behind more than 40 billion pounds ($53 billion) of debt and is the main focus of the repayment discussions. The National Audit Office said in October that one government scenario estimated as much as 80% of these loans, intended to keep small businesses afloat, could ultimately default.

The terms for the agencies are still under discussion. One option to manage the expected surge in non-performing loans is to ask multiple agencies to compete for tranches of debt, according to people with knowledge of the negotiations.

Banks and U.K. authorities have spent months grappling with the question of how to collect debts from businesses in the aftermath of the pandemic. While the loans are set to stay on banks’ balance sheets, the taxpayer will bear most of the cost of any defaults through state loan guarantees.

The Treasury and the Financial Conduct Authority have green-lit the plan in principle, according to the people. The entity is expected to be functional around May 2021, when the first repayments are due. A master service provider will oversee the process.

Spokespeople at the banks and the FCA declined to comment. A representative at the Treasury said it “will continue to look at ways to support firms as they recover.”

High Volume

It’s not unusual for U.K. banks to outsource bad debts to collection agencies, but the creation of a new panel to tackle the mountain of coronavirus loans highlights the challenge lenders face in an economy where the number of firms in significant financial distress is surging and one in ten companies fear going bust, according to a British Chambers of Commerce survey. The recovery process could be complicated by cases of fraud as well as exploitation by organized crime, which the National Crime Agency is investigating.

“There is no question we will need more than one debt collection agency,” said Stephen Pegge, managing director at UK Finance, which is coordinating the talks on debt collection. “We are trying to keep it very simple.”

Lenders want to avoid damaging their reputations by chasing companies in financial distress. The plan for a panel, initially advanced by the high street lenders including Lloyds Banking Group Plc and NatWest Group Plc, won the support of smaller lenders that have less capacity to pursue debts. Outsourcing the job, with collection agencies taking a commission on recovered loans, could also prove cheaper.

The banks themselves will still be responsible for the loans and will be accountable for the conduct of any external debt collectors they use, the people said. Banks must also show they have taken reasonable steps to recover the debt before they can claim state guarantees.

Last spring, banks and government briefly explored the idea of creating of a bad bank, where lenders could offload debts likely to go sour, as some did following the 2008 financial crisis. However, the Treasury said it wouldn’t allow such capital relief, according to the people. This option might resurface if defaults are far higher than expected next year, a person involved in the talks said, but it seems an unlikely option at the moment.

Difficult Place

Outsourcing is not a new concept. In Greece, the European country with one of the highest levels of non-performing loans, banks have heavily relied on collection agencies, even if they stopped short of the U.K.’s idea to establish a central entity to manage the task.

Quite often those specialized agencies do a better job than the banks, said Alex Boulougouris, co-head of research at Wood & Co Financial Services. “The outsourcing allows banks to go back to their regular activity rather than being consumed with the management of non-performing loans,” he said.

But a centralized structure comes with risks. Some bankers have raised concerns about losing oversight of loans on their books, the people said. Both banks and collection agencies have been criticized in the past for aggressive and unfair practices, including contacting borrowers repeatedly at odd hours, pursuing them on social networks or exerting pressure to sell their homes or take out more credit. NatWest was at the center of a scandal for lending practices at its Global Restructuring Group unit, which prioritized collecting debts over helping businesses recover.

Bankers, lobbyists and government officials are working on ways to standardize the practice and to create different levels of aggressiveness in pursuing the loans through the agencies. Banks will have a lighter touch with borrowers who suffer certain conditions such as mental illness, the people said.

“It’s very easy to look at numbers on the balance sheets but you have to look at the human stories behind those,” said Laura O’Sullivan, Accenture’s U.K. banking practice lead. “Customers might feel they are not being treated appropriately at the wrong moment of the credit cycle.”

©2020 Bloomberg L.P.